Indian façade and fenestration industry is directly linked to the construction and real-estate industry’s performance. The Indian window and door (all material) market was around Rs.10,000 crore in the year 2012 and Rs.13, 000 crore in year 2013-14. As per report by Ken Research, Indian doors and window market is expected to reach over Rs.15,000 crore by FY-2020.

Post your Requirement

Let us have a look at the factors which influence the façade and fenestration industry globally and in India:

Cities are engines of economic growth in India

Construction and Real Estate sector

A USD15 trillion industry worldwide in 2015, construction and real estate market is growing fast, especially in emerging countries, which will account for 55 per cent of the market–or USD10.7trillion–by 2020, according to Ovum, a London-based market researcher.

Real estate and construction activity remain a fundamental economic indicator anywhere on earth. Construction companies are increasingly tapping venture capital funding all over the world. Most progress will be carried out in the developing countries like India, where increased urbanization and improved standards of sustainable living are calling for immediate solutions. 90 per cent of construction workers and most infrastructure projects are being implemented in the southern hemisphere.

The United Nations predicts that 70 per cent of the global population will be living in urban areas by 2050, up to 54 per cent in 2016. Vertical buildings will replace current homes in Asia and Africa. Countries with a “highly dense” population (over 200 inhabitants per square kilometre) will need to make room for a booming population. India is expected to emerge as the world’s third largest construction market by 2020 by adding 11.5 million homes every year.

Real-estate Scene in India

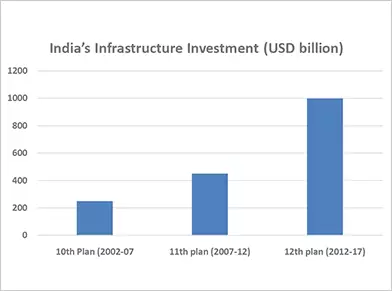

The Indian real estate market size is expected to reach USD180 billion by 2020. The housing sector alone contributes 5-6 per cent to the country’s Gross Domestic Product (GDP). The growth of this sector is well complemented by the growth of the corporate environment and the demand for office space as well as urban and semi-urban accommodations. In the period FY2008-2020, the market size of this sector is expected to increase at a Compound Annual Growth Rate (CAGR) of 11.2 per cent. Retail, hospitality and commercial real estate are also growing significantly, providing the much-needed infrastructure for India’s growing needs (Fig. 1).

Cities are engines of economic growth, and it is anticipated that 40 per cent of India’s population will live in cities by 2030. With the rapid rise in the proportion of people living in urban areas, there is an increasing requirement for sustainable cities. The Government of India along with the governments of the respective states has taken several initiatives to encourage the development in the sector. The Smart City Project, where there is a plan to build 100 smart cities, is a prime opportunity for the real estate companies.

Responding to an increasingly well-informed consumer base and, bearing in mind the aspect of globalisation, Indian real estate developers have shifted gears and accepted fresh challenges. The most marked change has been the shift from family owned businesses to that of professionally managed ones. Real estate developers, in meeting the growing need for managing multiple projects across cities, are also investing in centralised processes to source material, organise manpower and hiring qualified professionals in areas like project management, architecture and engineering.

The construction industry ranks third among the 14 major sectors in terms of direct, indirect and induced

Fig.1. India’s Infrastructure Investment (USD billion), Source: Planning Commission, Govt. of India

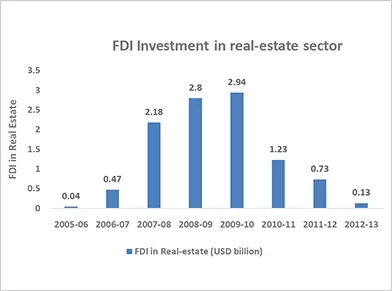

Fig.2. FDI Investment in real estate sector (source KPMG Study)

| Table 1: Number of launches in Real-estate segment in the first half of the year 2016 | |||||

| City | Segment | ||||

| Affordable | Mid | High-End | Luxury | Proportion* | |

| Ahmedabad | 2,445 | 1,217 | 266 | 266 | 58% |

| Bengaluru | 4,155 | 6,235 | 678 | 26 | 37% |

| Chennai | 0 | 2,274 | 1,080 | 0 | 0% |

| Delhi NCR | 2,985 | 4,229 | 400 | 0 | 39% |

| Hyderabad | 109 | 5,707 | 2,163 | 0 | 1% |

| Kolkata | 2,000 | 1,706 | 1,774 | 0 | 36% |

| Mumbai | 1,266 | 10,017 | 1,130 | 0 | 10% |

| Pune | 4,170 | 4,882 | 34 | 633 | 43% |

* Proportion of affordable housing units. (source: Cushman & Wakefi eld)

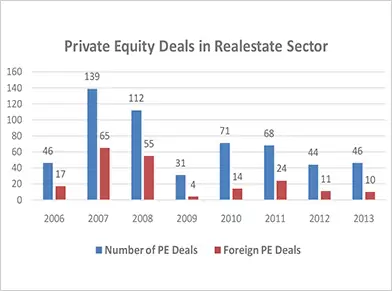

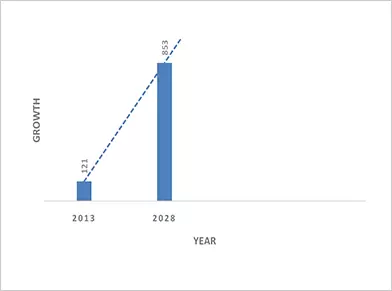

effects in all sectors of the economy. According to data released by Department of Industrial Policy and Promotion (DIPP), the construction development sector in India has received Foreign Direct Investment (FDI) equity inflows to the tune of USD 24.19 billion in the period April 2000-March 2016 (Price water house Coopers Report). Real estate sector has witnessed inflow of about USD 10.5 billion, which is about 5 per cent of total FDI inflow since 2005, says a KPMG study (Fig. 2). This figure is slightly less than the contribution of real-estate sector to Indian economy which is about 6 per cent. Several notable global investors are investing in India and are excited in the country real-estate development (Fig. 3 & 4). Several rounds of fund raising have been made and investors have yielded significant returns.

Data from Cushman & Wakefield, a real estate consultancy firm, shows that the number of launches in this segment in the first half of the year has doubled from the same period last year (Table 1). In the top eight cities alone, 17,000 new affordable housing units were launched, out of a total of 60,000. Ahmedabad and Delhi saw the highest proportion of launches in affordable housing segment in recent times. Prime Minister Narendra Modi’s mission of Smart Cities will surely transform the lives and living conditions of the citizens of the country.

The Fenestration and Façade Industry

Indian façade and fenestration industry is directly linked to the construction industry’s performance. The slowdown in the construction industry in recent times have resulted in a setback in the window and facade industry. The overall growth is around 20 per cent annually. But this is just for the interim.

Fig.3. Private equity deals in real estate sector (source KPMG Study)

Fig.4. Real estate sector value add 2013-2028 (USD Billion), Source: CREDAI Study

Global Market Size

The global facades market size is expected to reach USD 339.46 billion (Rs. 1.7 lakh crore) by 2024, according to a new study by Grand View Research, Inc. The surge in the adoption of advanced eco-friendly facades across the world is anticipated to fuel the market growth in the coming years. Furthermore, the increasing number of new building constructions, along with the rise in the number of renovation projects, is also anticipated to catapult the product demand over the forecast period, points out a study by study by Grand View Research, Inc.

The commercial segment witnessed a significant facades demand in 2015, says the study by Grand View Research. The availability of raw materials in abundance, such as aluminium, is anticipated to lower the product price over the forecast period. In addition to these market drivers, the development of solar panels that provide usable electric energy and its integration in the building skin is also anticipated to catalyse the industry growth over the forecast period.

Increasing number of new buildings catapult the product demand

According to Grand View Research, Inc , Asia Pacific dominated the industry and accounted for over 30 percent of the global share in 2015, which is expected to grow considerably over the next eight years, mainly due to the notable growth in the commercial and residential real estate sectors.

As per Grand View Research, Inc, the key companies operating in the market include Permasteelisa Group, Enclos Corp., Harmon Inc., Walters & Wolf, and SEPA, who focus on R&D spending to develop composite materials used for protecting buildings from natural as well as human instigated disasters.

According to a new research report by Global Market Insights, Inc., window and door (uPVC, Wood, Metal) market size was valued at over USD 82 billion in 2015 and is forecast to grow at 5.6 per cent CAGR from 2016 to 2024. It also suggests window and door market size worth over USD137bn by 2024.

Over the past two decades uPVC has taken over other traditional materials for making doors and windows in a significant way all over the globe and developed into the preferred material for door and window profiles due to its various features that improve quality of life, i.e. energy

Enquire Now for Window Profiles

The Constituents

The constituents of the facade & fenestration industry include fabricators, Material manufacturers and system companies. Various materials used in the industry are glass, aluminium extrusions, uPVC profiles, accessories, fittings, machinery, finished products, software, etc. System Companies provide technology, materials and service.

The Industry

- Fabricator – Manufacturers, Installers, Metal Working Companies, Sub-contractors…

- Material – Glass, Aluminium Extrusions, uPVC Profiles, Accessories, Fittings, Machinery, Finished Products,

Software… - Systems companies – providing technology, materials and service

The products:

- Fenestration (Windows & Doors) – Aluminium, uPVC,Wood and Steel

- Facades/ Curtain Wall – Aluminium

- Glass and Building Integrated PV (BIPV) Facades

- Solar Shading

Investors:

- Real-estate builders/ developers (commercial and residential projects)

- Public entities and businesses (airports, hospitals,hotels, schools etc.)

- Corporates (corporate buildings, IT parks etc.)

efficiency, lightweight, recyclability and low maintenance. The segment was valued at USD 27.5 billion in 2015 and would reach USD 47 billion by 2024.

The Market Size & Growth in India

The fenestration industry in India witnessed a leap in the 90s with an incredible growth in economy and the rising demand of the housing sector. By end 90’s the sector had to follow the ups and downs faced by the construction industry, which in turn depend on the state of the economy. However, the first few years of this century, a slowdown in the housing and real estate sector caused a setback to the doors and window market. We have seen a boom in this sector in the mid- 2000 and now we are witnessing steady growth. As a few positive signs of growth in the real estate sector become visible, the doors and windows market is expected to grow in the near future. Real estate capex is about 10-15 percent of the Indian GDP. In due course, when initiatives taken by the Government pick up momentum, the real estate sector would bounce back. When that happens, there’s going to be a significant uptake in the fenestration industry as well.

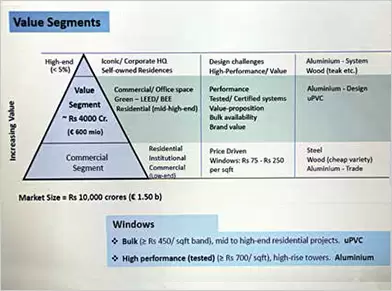

Fig.5. Value segments for façade and fenestration industry (Courtesy: ABK Consultants)

It is observed that, at present, the demand for the products are much higher in the Tier 2 and 3 cities than the metros. The 2008 -09 collapse forced builders/developers to move towards suburbs to offer low-cost housing, which saw a fall in window prices and specifications and this continued for the next 4-5 years. Better connectivity of these towns and cities have greatly helped the fenestration industry to reach out to the hinterland in India.

The rising middle-class population in India has created a market for the façade and fenestration products, offering new opportunities for growth at present. It is observed that commercial/ office spaces and green rated buildings have used certified fenestration products with high performance.

With the focus on green buildings, IT/ corporates buildings are to push volumes Aluminium facades and fenestration in prices bands more than Rs.7000 Sq m. Demand for new efficient facades too will increase value markets by over Rs. 2000 crores, says report by ABK Consulting (Fig. 5).

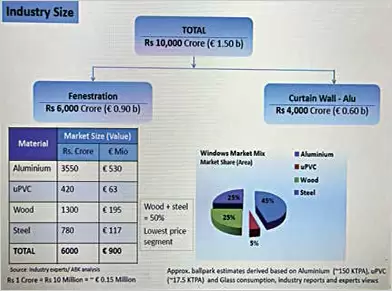

Fig.6. Industry Size for Fenestrations & Curtainwalls (Courtesy: ABK Consultants)

Fig.6. Industry Size for Fenestrations & Curtainwalls (Courtesy: ABK Consultants)Market sources say that in the past 5-10 years, demand for traditional steel and wooden doors and windows were decreasing while Aluminium & uPVC products were increasing. Going by the current rate, uPVC should capture about 25 per cent of the market by 2020, with lot of focus on energy efficiency, solutions to mitigate pollution hazards and better sound insulation (Fig. 6).

Enquire Now for Wooden Doors

With the propositions by the Government to build over 20 million new houses by the next 10 years, the real estate sector in India continue to seek greener pastures, thus the related segments, including windows & door market will grow again, though the past 10 years saw a slump in sales. It is also evident that, with huge number of multi-story apartments coming up, even in tier 2 and 3 cities, demand for traditional steel and wooden doors and windows were decreasing while Aluminium & uPVC products were increasing.

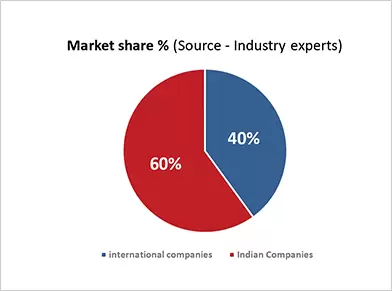

Fig.7. Size of the uPVC companies, India & International players, in the market in India

uPVC Product Market

At present, the market for uPVC products in fenestration & façade industry is about 7 percent. But popularity of UPVC products are going to reach new heights in the coming years. The reason being its price competiveness at expense of quality (Rs 350/ Sq ft (standard); Rs 900/ Sq ft (special)). There are over 150 fabricators in uPVC sector. The trade per retail is Rs 200+/ Sq ft. With over 80 per cent of it being unorganised, the industry also faces difficulties due to lack of standardisation.

Smart windows with lot of added values like double glazed windows with uPVC frames will take over market due to energy efficiency. Their use could reduce a building’s greenhouse gas emissions by half as compared to the use of aluminium framed windows. The experts in the sector are confident that the sector will become more organized by 2020 (Fig.7).

Internal research by UWDMA (uPVC Windows and Doors Manufacturers Association), the size of the uPVC marked in India has reached almost RS 1,500 crores. Considering that the overall market share of uPVC in fenestration is about 10 per cent, the fenestration industry would have a size of RS 15,000 crore. The Indian window and door (all material) market was around Rs.13,000 crore in year 2013- 14 and the market share of uPVC windows and door profiles share was about 6 to 7 per cent. In terms of the revenues, uPVC segment is expected to contribute at around 8 to 10 per cent of the total. The Indian uPVC doors and windows market is expected to grow at a CAGR of 7.0 per cent during 2015-2020. The major drivers of the Indian uPVC doors and windows market are increasing new housing construction and replacement activities, which have contributed to the growth of this market. Further Ken Research also suggests, over the next 10-15 years, the share of uPVC is expected to grow over 30 per cent in both new and replacement sales, majorly fuelled by the large, high rise apartment projects in urban cities. Key defining factors in this market are market maturity, fragmentation, competition, costmanagement, building legislation, ‘green’ building, tough market conditions and diversification. Growing awareness about the benefits of uPVC like low maintenance, energy efficient, thermal insulation, sound insulation etc. and demographic factors like increased urbanization, regulatory changes and replacement market in the country is expected to boost the growth of the uPVC windows and doors market.

Enquire Now for UPVC Windows

uPVC windows and doors

Aluminium Product Market

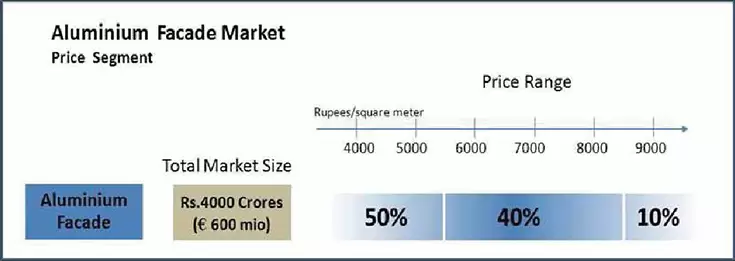

Aluminium still dominates the market compared to other options with its low cost and varying quality versions. From various reports, it could be assimilated that, at present, Aluminium dominates the fenestration market with 50 percent. India has a warm climate for most of the year, therefore it is understandable why aluminium has been the preferred and is a significant contributor to the fenestration industry over the years (Fig. 8).

Steel Window & Door Market

It is observed that in the past 5 to 10 years, demand for traditional steel and wooden doors and windows were decreasing. Ten years back more than 90 per cent of doors and windows were made of wood. Even then steel windows and doors holds 25 per cent of the market share. Traditional steel is still used in low cost houses and in rural areas with a share of about 12-20 per cent.

Steel doors and windows are at the bottom of the pyramid. This could be because of the lack of standards, specifications, and low/no performance. Price range Rs. 75 to Rs 100/ Sq ft. It is mainly used in low-end housing, industrial sheds etc. Rest 20 per cent, steel tubes, powder coated Rs 200/ Sq ft. It is mainly used in institutional buildings, Government buildings etc.

Fig.8. Aluminium Façade Market. Source: ABK Consulting

Wood Window & Door Market

Window Market : Wood is on the downslide with about 19 to 25 per cent share. Market for wood windows and doors is decreasing because of its scarcity, maintenance issues and increased cost. At present, high-end villas and luxury apartment owners still prefer wood. Here, classic wood windows, (Burma teak) costing over Rs 1500/Sq ft is preferred. There are only a couple of state-of-the-art industrial manufacturers who can cater to this section.

But more than 85 per cent wood used for making windows and doors is low-end, cheap wood. Its price range is less than Rs 250/ Sq ft. this is to cater for low-end housing. These windows are fabricated mostly by local individual and group of carpenters on site.

Door Market : But wooden doors still finds great demand. More than 90 per cent of all doors used are wooden doors. But only about 10 per cent of the market is organised industrial enterprises. Moulded Shutters (Block-board core, veneered or Masonite skin or laminate) priced at Rs 125 to Rs 300 per Sq ft are preferred. In the market 90 per cent business is for plain flush doors, with prices starting from Rs. 65 per Sq ft. Very high-end solid wood (Beachwood / Ashwood) are of over Rs 700/Sq ft.

Enquire Now for Flush Doors

Glass and Mirror Market

Flat glass has created significant place in the glass industry not just in India but on a global level (Table 2). Total size of flat glass industry in India is 0.12 million tonnes per month. Indian Glass Industry consists of architectural, automotive, value added glass, mirrors & furniture segment which has market share of 45 per cent, 15 per cent, 15 per cent, 10 per cent & 15 per cent respectively. The majority of the sales in terms of value is dominated by float glass segment and further in the coming years sales in float glass segment of the Indian glass industry will increase on the side-lines of real estate growth across retail, residential and office estate.

| Table 2: Indian Glass Industry – Market Analysis, source | |

| Present market size of India | 6600 TPD approx |

| Present production capacity | 5160 TPD approx |

| Average industry yield 90% | 4650 TPD approx |

| Average import of raw glass | 900 TPD approx (after anti-dumping duty) |

| Average import of mirror | 135 TPD approx |

| Average import of processed glass | 900 TPD approx |

| Total demand | 6585 TPD approx |

| The Compound Annual Growth Rate (CAGR) is around 13-15%. |

|

Indian Glass Market is estimated to Increase at a CAGR of 13 to 15 per cent over the next three years. Fuelled by growth in sectors like real estate, infrastructure, retail, automotive, etc., the country’s glass industry will acquire a market size worth Rs. 340 billion by 2015 from Rs. 225 billion at present, according to a study by industry body Assocham.

The glass consumption growth is expected in construction (10 to 12 per cent), automotive (20 per cent), consumer goods (15 to 20 per cent) and pharmaceuticals (15 to 18 per cent) sectors. The growth in the glass industry is characterised by the increase use of processed & reflective glass as the Indian customer has become more aware about the importance of glass in effectively addressing the concerns of safety and energy efficiency.

Adhesives and Sealants Market

Adhesives and sealants is a 20-million-tonne global industry with a sales value of over USD30 billion. Of this, the sealant industry contributes only USD5 billion. A study by Apitco reveals that Silicone based sealants market is growing very fast as use of sheet glass in construction and partitions goes up. Sealants also have automobile and industrial uses.

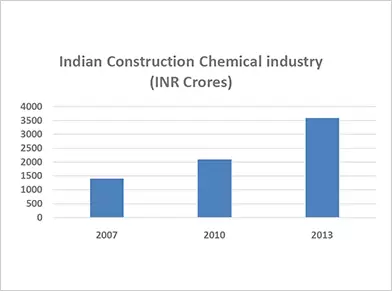

In India and across the world, the industry is fragmented. There are many companies that manufacture various types of products. Indian construction chemicals industry currently stands at Rs. 3,600 Crores and has shown a strong growth of 17 per cent over the last 5 years. It increased from Rs.1,400 Crores in 2007 to Rs.3,600 Crores in 2013 (Fig. 9). Share of adhesives and sealants is high in Indian market as compared to developed world, which is about 18 per cent of the total construction Chemical market. Increase in urbanization has further boosted the growth of construction chemicals industry.

Adhesives and Sealants Market

Sealants are used to seal expansion joints, cracks, joints in concrete roads and to fill gaps between concrete. Major types of sealants include the following:

- Polysulphide sealants: These are most commonly used in the construction industry as expansion joints for concrete roads, structural joints and others.

- Polyurethane sealants: These are used for high-end applications where high flexibility and bonding strength are required.

- Silicone sealants: These are generally used where good bonding is required between two dissimilar surfaces such as fixing of glass on metal frame

Enquire Now for Door Frame

Growth of Indian construction chemical industry

Sealant Industry

Global silicone sealants market size was estimated at over 550 kilo tons in 2015 and is likely to exceed 820 kilo tons by 2023 and is expected to grow at over 4.5 per cent from 2016 to 2023. Globally Silicone sealants market size was dominant with valuation estimated at over USD 2 billion in 2015 (Rs.13000 crore). Construction sector represents the dominant segment for silicone sealants demand. Growth in end-use industries such as construction, automobiles and machinery is likely to drive demand. Polyurethane (PU) sealants occupied a share of close to 28 per cent in 2015.

In India, sealant market size is Rs.250 crore with year on year growth of 20 percent (Table 3). They are primarily used in construction applications such as weatherproofing of nonporous & porous substrates, sealing expansion joints, sanitary joints in bathroom & kitchen fixtures, electrical conduits, fire-rated joints on pipes, ducts and electrical wiring in ceilings & within buildings. These are also used to perform the function of an adhesive in the form of structural sealants. For instance, silicones are used in structural gazing in which the cured sealant forms the part of overall load bearing design. Structural gazing is the most important application carried out by silicone sealants owing to outstanding durability.

| Table 3: Sealant market size | |

| Global Market size | USD 2 billion(Rs.13000 crore) |

| Indian Market Size | Rs. 250 crore |

| Global YoY growth | 5% |

| India – YoY growth | 20% |

| India – Future growth perspective 2020 | 20 % YOY |

Marketing Challenges in Window & Façade Industry

Major causes of concern:

- Cheap imports

- Nonstandard pricing

- Heavy import duties and competition from cheap Chinese products

- Lack of market acceptance

- Unorganized structure

- Nonstandard manufacturing practices, absence of certified products

- Poor quality products

- Overheads in design, production and management costs

- Lack of awareness about quality in architects and end customers

- Lack of knowledge on correct glazing, correct sealing gaskets

- Competent assessment authority

- Current market slowdown, tight cash flow,project delay

- Lack of technical knowledge, availability of skilled man power and turnover ratio of the employees

- Lack of push/exposure with retail sector

- Price wars and infighting within uPVC players

- Limited demand

- Fabrication standards to match international parameters

- Good and right quality of hardware for Windows

Conclusion

The prospects for façade and fenestration industry in the immediate term remain relatively good, although a volatile economy casts some uncertainty over short term prospects. However,the India is performing relatively well and a steady improvement in the Façade and fenestration market in the medium term is anticipated. The market for residential windows is very competitive and is likely to remain so, though within the next few years we expect capacity and demand to become more balanced as demand from the house building sector continues to expand, resulting in less pressure on supplier prices and profitability.Ultimately, the industry need to be mature and, in the longer term, heavily dependent on replacement demand in the residential sector, supported by new build activity in key non-residential markets.

Based on the comments from all the industry leaders and reports, we can come to an inference that with huge projects announcements from the Government like 100 smart cities, and with the propositions by the Planning Commission to build over 20 million new houses to be built in the next 10 years, the real estate sector in India continue to seek greener pastures, thus the related segments, including windows & door market will vroom again, though the past 10 years saw a slump in sales. It is also evident that, with huge number of multi-story apartments coming up, even in tier 2 and 3 cities, demand for traditional steel and wooden doors and windows is decreasing while Aluminium & uPVC products is increasing. Popularity of UPVC products are going to reach new heights in the coming years.

Post A Comment