Windows and doors play an important role in design aesthetics and energy performance of buildings, be it commercial, institutional or residential. They provide physical and visual connection between the inside and outside and enhance the overall appeal of the building.

Post your Requirement

Enquire Now for Doors

Rising demand for well-designed windows has led to innovations in the quality and texture of the windows. Beyond aesthetics, windows are expected to perform other functions such optimizing day-lighting, insulation, energy conservation, noise attenuation and pollution control. There is great demand for windows and doors that need lower maintenance and are made of energy saving, efficient materials. With the increase in consumer aspirations, premium quality products have achieved a higher and faster market penetration globally.

The door and windows market is still growing, as people are exposed to innovative products and increasingly looking for enhanced lifestyle and living standards. The shifting interest of people towards the inclusion of uPVC windows in India offers great potential for premium products and brands to set up and grow their business in the country. This article provides an insight into the operating environment of the uPVC windows and doors industry in India.

Fenestration Industry: Past & Present

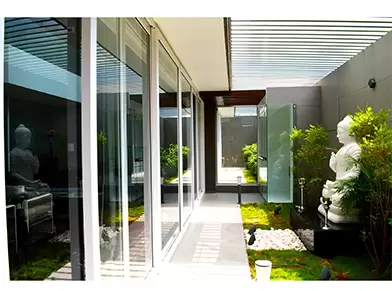

Villa Windows by Fenesta

The fenestration industry in India witnessed a leap in the 90s with incredible growth in economy and the rising demand of the housing sector. By end 90’s the sector had to follow the ups and downs faced by the construction industry, which in turn depend on the state of the economy. However, the first decade of this century, a slowdown in the housing and real estate sector caused a setback to the doors and window market. As a few positive signs of growth in the real estate sector become visible, the doors and windows market is expected to grow in the near future.

Enquire Now for Fenesta Building Systems

Saket Jain, Business Head

Saket Jain, Business Head

Fenesta windows & doors points out that the Indian fenestration industry is directly linked to the construction industry’s performance. The slowdown in the construction industry in recent times have resulted in a setback in the window industry. The overall growth is around 20 per cent annually. He observes that retail is still on a steady growth path, though project business has shown a slump in the last couple of years. Jain is optimistic since there have been positive sentiments in the last few months.

Farid Khan, Director & CEO,

Profine India Window

Technology Pvt. Ltd

Farid Khan, Director & CEO

Profine India Window Technology Pvt. Ltd too agrees that 90s witnessed rapid growth in the demand for doors and windows along with growth of real estate sector and the growth kept increasing since early 2000. “We have seen a boom in this sector in the mid-2000 and now we are witnessing steady growth,” says Khan. India is in a phase of huge projects announcements, especially from Government, like 100 smart cities, which provides huge opportunity for doors and windows industry. For Khan, all this is a sign of a more fruitful environment for fenestration industry.

Robert Höllrigl, President -R&D

& Maja Hoellrigl, President

– Marketing & Operational

Systems, Encraft India Pvt Ltd

Robert Höllrigl, President – R&D & Maja Hoellrigl, President – Marketing & Operational Systems

Encraft India Pvt Ltd states that the real estate boom of the 90s continued for almost a decade, especially when a lot of housing societies came up in different parts of Delhi and when the culture of multi-storied apartments started. “Though the phase of such boom in multi-storied apartments has fizzled out in cities like Delhi & Mumbai in the last few years, the same has shifted to Gurgaon, Noida, Lucknow in North Pune, Lavasa, Powai, Thane etc., in the west and also to cities like Chennai, Bangalore, Hyderabad in the south, where the culture of multi-story apartments had picked up”, says Robert.

Mario Schmidt, Managing

Director,Lingel Windows

& Doors Tech (P) Ltd

Mario Schmidt, Managing Director

Lingel Windows & Doors Tech (P) Ltd also agrees on the present slump in the construction sector. “With unsold assets of upto 30 per cent, developers are under extreme pressure, especially in NCR and Mumbai. This has affected fenestration sales too,” he adds.

Smita Limaye, Project

Technical Support, Ege Profil

Tic. ve San.A.S. – Deceuninck

Smita Limaye, Project Technical Support

According to Smita Limaye, Project Technical Support, Ege Profil Tic. ve San. A.S. – Deceuninck, the demand for the products are much higher in the Tier 2 and 3 cities than the metros. The 2008 -09 collapse forced builders/developers to move towards suburbs to offer low-cost housing, which saw a fall in window prices and specifications and this is expected to continue for the next 4-5 years. Better connectivity of these towns and cities have greatly helped the fenestration industry to reach out to the hinterland in India.

William Chen, South India Zonal

Manager, Kinlong Hardware

William Chen, South India Zonal Manager

Kinlong Hardware observes that in the past 5-10 years, demand for traditional steel and wooden doors and windows was decreasing while Aluminium & uPVC products were increasing. As the standard of living is improving in India, there is more demand for new apartments and consequently for better doors and windows. But it is still in a nascent stage since consumers have relatively less knowledge about latest products. Ten years back, more than 90 per cent of doors and windows were wooden and now aluminium and uPVC doors and windows are becoming more popular. There are few new products like tilt-and-turn, and sliding folding series in the market, but enquiries are comparatively low.

Arun Sharma, Managing

Director, aluplast India Pvt. Ltd

Arun Sharma, Managing Director

Aluplast India Pvt. Ltd, finds that the quality uPVC fenestration solutions market is still growing at a good pace and he hopes that it will continue to do so.

However, Rajiv Gupta, Secretary, uPVC Windows and Doors Manufacturers Association (UWDMA) observes that there is a slow-down in the uPVC sector since projects initiated by Government and private sector are sloppy.

Narendra Patel, Managing

Director, Torfenster System

India Pvt Ltd

Narendra Patel, Managing Director

Torfenster System India Pvt Ltd says that in 90’s the definition of windows and doors was different. It was just a necessity. Now home designers are considering different benefits of the product too.

Jean-Gabriel Creton,

CEO, Euradif

Jean-Gabriel Creton, CEO,

Euradif also agrees that there is a strong interest in the PVC segment in India. Decorative door panels for entrance doors in PVC and aluminium have been used for more than 20 years in Europe. The demand for this concept is catching up in India.

Villa Chandigarh by Aluplast

Innovative windows from Torfenster

Based on the comments from all the industry leaders, we can come to an inference that with huge projects announcements from the Government like 100 smart cities, and with the propositions by the Planning Commission to build over 20 million new houses to be built in the next 10 years, the real estate sector in India continues to seek greener pastures, thus the related segments, including windows & door market will vroom again, though the past 10 years saw a slump in sales. It is also evident that, with a huge number of multi-story apartments coming up, even in tier 2 and 3 cities, demand for traditional steel and wooden doors and windows was decreasing, while the demand for Aluminium & uPVC products was increasing. With an increasing number of townships in Delhi NCR, the popularity of uPVC windows in Noida and Gurgaon is going to reach new heights in the coming years.

Enquire Now for Wooden Doors

Sales of uPVC, Aluminium, Wood, and Steel Windows & Doors

Saket Jain of Fenesta and Robert Höllrigl of Encraft perceive that Aluminium still dominates the market compared to other options with its low cost and varying quality versions. The use of wood and steel windows has become quite negligible. uPVC has become more acceptable than what it used to be five years ago and the market share is growing. Narendra Patel from Torfenster too notes the same and comments that the need for wood windows is decreasing because of its scarcity, maintenance issues and increased cost.

Bi-fold doors by Deceuninck

Aluminium ready to install door used as the main door – Model

DERCETO, Euradif

“As per my information and our internal research with our association UWDMA, the size of the uPVC market in India has reached almost Rs 1500 crores. Considering that the overall market share of uPVC in fenestration is about 10 per cent, the fenestration industry would have a size of RS 15,000 cr”, observes Mario Schmidt of Lingel Windows & Doors. We know that for all economical, budget buildings and houses, Aluminium or low-quality wood is the main material used. According to Mario, 80 per cent of the market goes to those materials.

Arun Sharma also remarks that in India, the share of aluminium as a window profile material is about 70 per cent and that of uPVC is at about 5-7 per cent. In Europe, the share of uPVC as profile material is much higher at around 55 per cent. Smita Limaye of Deceuninck observes that Steel also has a share of about 25 per cent.

Enquire Now for Window Frame & Profiles

Jain (Fenesta) explains that the Aluminium Window Industry is estimated to be around 50-55 per cent whereas Wood is on the downslide with about 19-20 per cent share. Traditional steel is still used in low-cost houses and in rural areas with a share of about 11-12 per cent. uPVC is window industry is hovering around 14-15 per cent and is expected to grow at a steady pace. But according to Höllrigl, the share of uPVC is still in the single digits.

uPVC windows are better as compared with low-segment aluminium, but surely you can get all benefits in higher-segment aluminium windows at a comparatively higher price than uPVC, says Narendra Patel of Torfenster. Price is a big factor in India. Manufacturers are selling windows at a lesser price to sustain and as a result of that, they have to compromise on the quality which is a very critical point for the uPVC window industry. The solution is to increase technical knowledge and never compromise on the quality because of market war. Ultimately it will spoil the uPVC industry over a period of time, adds Patel.

Enquire Now for UPVC Windows

From these discussions, we could conclude that Aluminium dominates the fenestration market with 50 per cent, followed by wood, steel and uPVC hovering around 22 per cent, 18 per cent and 10 per cent, respectively.

Contact more manufacturers and suppliers to know about City-based market scenarios. Below is the detail of the top cities wherein you get a selected list of top manufacturers. Get instant quotes now.

Top City City Based Manufacturers Resource uPVC Windows (Manufacturers, Suppliers & Dealers) Bengaluru uPVC Window Manufacturers In Bangalore Chennai uPVC Window Manufacturers In Chennai Delhi UPVC Window Manufacturers In Delhi Hyderabad uPVC Window Manufacturers in Hyderabad Coimbatore UPVC Window Manufacturers in Coimbatore Mumbai uPVC Window Manufacturers in Mumbai Kolkata UPVC Window Manufacturers in Kolkata uPVC Doors (Manufacturers, Suppliers & Dealers) Bengaluru uPVC Door Manufacturers in Bangalore Chennai uPVC Door Manufacturers in Chennai Delhi uPVC Door Manufacturers in Delhi Hyderabad uPVC Door Manufacturers in Hyderabad Coimbatore uPVC Door Manufacturers in Coimbatore Mumbai uPVC Door Manufacturers in Mumbai Kolkata uPVC Door Manufacturers in Kolkata

uPVC Vs. Aluminium

All industry leaders agree that both uPVC and Aluminium are on par with respect to strength and performance. Though Aluminium is widely used now, uPVC would be the most preferred material in future, with improvements to frame appearance, weathering performance, thermal insulation, ergonomics, raw material efficiency, sophisticated hardware and frame durability. Moreover, it would be more cost-effective and eco-friendly.

Enquire Now for Door Frame & Profiles

Smita Limaye says that certain sizes of uPVC offer better performance in terms of heat reduction, noise and weather tightness. For very big sizes, Aluminium scores better as new extrusions can be produced at lesser cost and in a faster time than uPVC. Bigger openings in uPVC lead to bigger profiles, steel reinforcement and heavy-duty hardware which may make the window look bulky. Sleek window systems have been launched by many Aluminium system companies which offer floor-to-roof sliding systems. Proper orientation of the building/window for such systems is essential – west/south-west facing huge windows would be a large heat source.

According to Saket Jain, in recent years, the use of uPVC has grown in popularity due to low maintenance needs. Aluminium is resilient but can pick up rust whereas uPVC never rots flakes, rusts or fades. uPVC is also the most durable of the materials available. uPVC frames are constructed to the utmost hardness making them extremely difficult to break or damage. Aluminium is similar, if not more secure and is considered burglar-proof due to its strength. Besides, uPVC is considered a green material because it can be recycled and helps in reducing the use of wood. The energy required to manufacture uPVC profiles is far lesser than that of aluminium.

Enquire Now for Aluminium Doors

uPVC window profiles are reinforced with steel windows. Therefore, the advantage of aluminium over uPVC in terms of strength is offset, says Arun Sharma. In terms of performance, it is advisable to go for quality uPVC profiles as they are well-engineered system products coming with Eurogroove etc. which make for more durable and high-performing window solutions.

He too stresses that uPVC profiles are more energy-efficient, eco-friendly and durable.

Robert Hoellrigl states that the perception of uPVC frames and screens as a weak component is a baseless one. It can match the strength of Aluminium and provides a uniquely engineered, sophisticated outer cover to house a well-engineered steel profile that provides the actual strength. Cleverly designed uPVC frame coupling arrangements and/or static bars (also known as Hurricane bars) provide additional strength to cope with wind pressure, security and human safety (passenger loading). High performance is built-in by design into every uPVC frame requiring that the correct components like steel reinforcements, gaskets, hardware and fasteners are used. The material cost difference between solid Aluminium frames and steel-reinforced uPVC frames is virtually negligible when the same glass and hardware are being used. The Government’s effort towards CO2 and energy cost reduction will necessitate the introduction of thermally broken Aluminium frames. This will favour uPVC framing, even more, says Hoellrigl. Even Aluminium’s well-propagated recycling advantage has been matched nowadays by uPVC’s outstanding material properties.

According to Jean-Gabriel Creton, an entrance door has to be solid, secured and appealing. Aluminium is an ideal product from this aspect when coupled with suitable locks, hinges or even electrical locking systems ad biometric readers. The interior door in its allure needs to be beautiful, original, easy to maintain and affordable in terms of price. uPVC perfectly meets these requirements.

It makes little sense to compare uPVC with Aluminium, says William Chen. Aluminium windows & doors have good fire resistance and with exotic appearance. It is weak in integrity, easily deforms and has weak heat & sound insulation. But the use of advanced aluminium can improve these qualities quite a lot. uPVC has become very popular only in the last 5 years. The major issue at present is a scarcity of patterns. Its hardware fittings are not good quality and not diverse. Besides, the recycling technology of waste materials is not good enough, says Chen.

“In my opinion, it is important to compare the right products”, says Mario Schmidt. “Local aluminium sections available should not be considered in comparison between uPVC. For a customer it is always advisable to have a look at the final product/sample before making any decision”.

A good system in Aluminium and an equivalent uPVC window will have the same performance. It will be finally the customer’s choice, whether he likes the “metallic sound” of the Aluminium window or the feel of the wood while using uPVC windows. Both Systems, if designed correctly, are able to meet the structural requirements and create large span openings. In terms of thermal insulation, of course, uPVC is much better than non-thermal break Aluminium. Thermally broken Aluminium sections are similar to uPVC sections, declares Mario. “I`m excited that slowly this high-end product range of thermal break Aluminium is finding acceptance in India as well”, he noted.

Farid Khan says that fusion-welded corners of uPVC Windows prevent the entry of water through joints. Structural strength can be imparted with a careful selection of profile systems and thereby suitable for high rise dwellings. But Introduction of uPVC to the Indian market has been late and is taking time to create market awareness.

“If we talk about the challenges and solutions”, delves Khan, “then we can say ‘awareness’ is like two sides of the same coin, it is a challenge as well as a solution for the uPVC fraternity to create awareness amongst the consumers who still have a connection with traditional material like wood and steel”. A possible solution is to inform architects, builders, government bodies etc. about the benefits and advantages of uPVC. India being a tropical country, sees large temperature variations and if manufacturers are to be believed then, uPVC can easily pass off these conditions.

Market Challenges

Speaking about the challenges faced by the uPVC sector, Saket Jain of Fenesta points out that cheap imports are still a major cause of concern. Pricing is another important factor in the Indian market. Heavy import duties and competition from cheap Chinese products will always be a major challenge in the market. Market acceptance is also necessary as uPVC is relatively a new concept in the Indian market. Most of the windows sector is still unorganised, manufacturing practices nonstandard and, inefficient, resulting in poor quality products at times.

For Arun Sharma and Smita Limaye too the major challenge of the window sector is its unorganized structure. According to Sharma, in most cases, window decisions of house owners are more of an afterthought rather than a priority when constructing a house. This results in the decisions and considerations on fenestration choices often being made too late.

Great door designs- Torfenster

Project by Torfenster

Smita Limaye says that uPVC window producers are better equipped with modern machines and factory setup but often treated on par with on-site fabricators. According to her, there is always a huge gap in prices due to the overheads in design, production and management costs.

Due to the absence of standards, customers find it very difficult to compare products and understand the price and quality differentials and could end up buying poor quality products at high prices, notes Limaye.

William Chen of Kinlong Hardware too complained of companies wanting to make fast money, taking advantage of the absence of standards. In the process, the reputation of the industry has suffered damage.

According to Robert and Maja Hoellrigl, the first and foremost challenge faced by the uPVC window suppliers is to make the influencers like architects and end customers understand the difference between good quality uPVC systems and bad ones since all uPVC systems look alike. The customer is unaware of the parameters that differentiate between good and bad uPVC. Ideally, the product standard would come first and a competent assessment authority would join shortly afterwards to certify components and/or manufacturers. India could benefit from 6 decades of uPVC window know-how, extensive material R&D and proven European (EN) standards, says Robert and Maja. It would be prudent to adopt EN standards as an interim measure until BIS is ready to issue an official standard for uPVC fenestration.

Narendra Patel emphasises the need for standards such as BIS for fenestrations in India. There should be a regulatory body to maintain quality parameters and improve specific fields, says Patel. As of now, it is extremely easy and economical to set up a uPVC door & window manufacturing unit involving low capital investment, and the availability of low-quality equipment and machinery. This leads to the manufacturing of sub-standard products.

You may be interested in uPVC door manufacturers and Suppliers

With the growing number of façade and window consultants in the country, the industry will mature and stress quality rather than going for cheap material. With standardisation, the specification on design blueprints too can be unified and this will help the suppliers to go into mass production and deliver it on time. Since the scope is huge, the sooner we bring in regulations for standardization, the better for the industry and the consumer. Delivering high-quality products will become possible.

According to Mario Schmidt of Lingel, unorganized situations at construction sites are a major issue. The timely readiness of openings for production and installation is a challenge. It is again almost impossible to make a production planning programme in advance.

The personal effort of the salesperson is the key to success in this industry today, says Mario. Providing the best possible service and personal attention to all possible mistakes will raise the company’s value. Changes in the pricing policy of competitors have positive and negative impacts. There is a slowdown in the construction sector and the entire industry is under pressure to work at rates that are practically impossible.

Farid Khan points out that many channel partners/ fabricators face similar problems like tight cash flow, project delay, competition from cheap Chinese material and lack of awareness on part of the customer. The segment needs more informative campaigns to create better awareness. Narendra Patel of Torfenster finds lack of technical knowledge availability of skilled manpower and turnover ratio of the employees as major challenges.

Rajiv Gupta, Secretary, UWDMA observes a serious lack of push/exposure with the retail sector, and lack of knowledge with respect to inherent values the concept offers versus cost are a few major challenges. Price wars and infighting within uPVC players in this scenario of limited demand at this nascent stage is another hurdle.

Challenges in the uPVC Window Industry Faced by the System Suppliers: Robert and Maja Hoellrigl, feel that the foremost challenge is to improve the fabrication standards to match international parameters. Ensuring the use of good and right quality hardware for Windows, correct glazing, correct sealing gaskets etc. is also a challenge. As mentioned earlier, price is a more important parameter than quality or performance in India today, due to which the fabricator tends to cut costs by the use of inappropriate hardware.

Since the end customer always looks at the complete window or door as the product of the brand, it becomes very important for the system suppliers to ensure that their fabricators use good quality hardware, maintain high fabrication standards, follow parameters recommended by the company for steel reinforcements, effective sealing gaskets and correct glazing, over and above the application of high quality & appropriate uPVC profile system. Rajiv Gupta, Secretary, UWDMA feels that much is about controlling and disciplining the fabrication fraternity and profile extruders with an element of transparency.

Future of the Fenestration Industry

Farid Khan of Profine India Window is very optimistic about the future of the industry. The announcement of 100 smart cities, infrastructure projects, increase in FDI and emergence of the middle class give a clear indication that the door and window market will gather pace and create more opportunities for the uPVC segment. Published reports suggest that the Indian uPVC doors and windows market is expected to grow at a CAGR of 7.0 per cent from 2015-to 2020.

Smita Limaye of Deceuninck expects the fenestration business in our country to touch Rs 15,000 Cr by 2020 and is hopeful about evolving technologies too. The uPVC industry has moved from using lead stabilizers to completely lead-free products in the last decade. High-performance window systems with a U value of less than 1 have been developed though they are yet to enter the Indian market. She expects that superior product like uPVC tilt and turns window, lift and slide, bi-fold, pivoted windows, wave door, tilt and slide doors and many more designs will penetrate the market and would surge by 2020.

Saket Jain, Business Head, Fenesta feels that going by the current rate, uPVC should capture about 25 per cent of the market by 2020, with a lot of focus on energy efficiency, and solutions to mitigate pollution hazards and better sound insulation.

William Chen and Arun Sharma are confident that the sector will become more organized by 2020. uPVC is poised to achieve higher and faster market penetration in the years to come and wood, steel and aluminium will become less common. Robert and Maja foresee that with metros and big cities becoming noisy and getting more and more polluted, uPVC window & doors, in particular, is expected to become a priority area for the customer segment in middle and upper-income group segment across metros and mini-metros, thinking about building or renovating their dream homes.

Mario Schmidt also expects to witness a huge change over the years the next 5 years and presumes that the speed is to continue. He hopes that the development/housing sector will improve, and developers will have a chance to use better products, and introduce new technologies to finally benefit the buyer. Branded companies, system providers and members of UWDMA would be able to educate the market/consumers so that the products do not move in the wrong direction, which the low-end Aluminium did 20 years ago.

Smart windows with a lot of added value like double glazed windows with uPVC frames will take over due to energy efficiency. Their use could reduce a building’s greenhouse gas emissions by half as compared to the use of aluminium framed windows.

Also, read our ultimate guide on uPVC Doors & uPVC Windows.

Global Window & Door Demand

According to a study from The Freedonia Group, Inc., a Cleveland-based industry research firm, global demand for windows and doors is projected to rise 5.9 per cent annually through 2019 to $233 billion. Slowing growth in building construction spending in the Asia/Pacific region (the largest regional market for these products) will restrain demand gains. Window and door demand will accelerate in higher-income areas such as the US and many countries in Western Europe because of rebounds in housing construction. Through 2019, the fastest demand gains are expected in plastic windows.

Even with its deceleration, window and door demand in the Asia/Pacific region is forecast to expand 6.8 per cent per annum through 2019, a faster pace than that in any other region. Rising personal income levels in the developing countries of the region will allow consumers to purchase more modern windows and doors.

China was the largest national market for fenestration products in the world in 2014 and will see its share of global demand rise from 36 percent in 2014 to 39 percent in 2019. China is expected to post fenestration product demand gains of 7.6 percent per year through 2019, a deceleration from the double-digit annual gains of the 2009-2014 period but still among the fastest in the world.

North America will enjoy the second-fastest demand growth of any region through 2019, boosted by gains in the US and Mexico. The large US market for windows and doors is expected to advance 7.3 percent per year through 2019 as housing construction in the country continues to rebound from the sharp contraction it suffered between 2006 and 2011.

The Africa/Mideast region is also expected to post rapid window and door demand gains through 2019. Growth will be above the global average due to strong increases in building construction spending as well as rising personal income levels that will allow the adoption of more advanced building practices, encouraging the use of modern fenestration products.

Western Europe, which posted gains of less than one percent annually between 2009 and 2014, and Japan are also projected to see an acceleration in demand through 2019, though growth will still remain below the global average.

| WORLD WINDOW & DOOR DEMAND (billion dollars) | |||||

| % Annual Growth | |||||

| Item | 2009 | 2014 | 2019 | 2009-2014 | 2014-2019 |

| Window & Door Demand | 124.5 | 174.5 | 232.8 | 7.0 | 5.9 |

| North America | 26.3 | 29.6 | 40.5 | 2.4 | 6.5 |

| Western Europe | 32.8 | 33.2 | 39.1 | 0.2 | 3.3 |

| Asia/Pacific | 48.9 | 91.8 | 127.5 | 13.4 | 6.8 |

| Source: The Freedonia Group Inc. | |||||

Post A Comment